Seminggu yang lalu, saya baru berkesempatan membaca surat terbuka Siti Hajar Aladin kepada Perdana Menteri Malaysia. Di antara

isi kandungan yang menarik perhatian adalah masalah kenaikan kos

kehidupan, gaji yang rendah dan peluang membeli rumah sebagai pelaburan. Saya terpanggil untuk menulis artikel ini memandangkan tiada balasan surat beliau daripada pihak Perdana Menteri Malaysia (kalau ada balasan secara peribadi, itu di luar pengetahuan saya) dan tidak ada sebarang pihak yang cuba memberikan nasihat yang bernas kepada Siti Hajar. Sebaliknya lebih ramai orang yang bersorak dan bertempik kerana surat terbuka tersebut. Ramai yang terbantut pemikirannya dan hanya menerima bulat-bulat yang disebarkan.

Pemikiran yang ditunjukkan oleh beliau merupakan pemikiran yang dimiliki oleh majoriti masyarakat Melayu dan mereka yang tamat pendidikan pengajian tinggi. Ramai dari kalangan mereka yang beranggapan pemilikan ijazah akan memberikan kekayaan dan kemewahan di dalam hidup mereka. Namun mereka lupa bahawa pendidikan yang diterima di peringkat pengajian tinggi tidak mengajar mereka bagaimana menjadi

jutawan. Jika terdapat para pensyarah mengajar matapelajaran tersebut, mereka

orang pertama akan berhenti dari mengajar kerana telah mengetahui rahsia

membina kekayaan! Pendidikan di sekolah dan universiti dibentuk untuk membolehkan mereka berkhidmat

kepada majikan. Oleh itu, untuk membina kekayaan, lepasan ijazah harus belajar

daripada mereka yang telah berjaya membina kekayaan, menghadiri seminar, rajin

membaca dan membentuk pemikiran bijak kewangan.

Untuk menjawab perkara pertama, anda boleh baca artikel saya yang lalu iaitu:

1. Personal Finance and Investment

2. Property Investment Growth - value added house and shop

Terdapat 4 faktor utama yang menyebabkan kenaikan kos kehidupan. Dua

di bawah kawalan kerajaan dan dua lagi di dalam kawalan mafia

antarabangsa. Namun, ke empat-empat faktor ini boleh anda atasi jika

anda memahami bagaimana 4 perkara tersebut bekerja. Sebelum tahun

1980an, bilangan kaum wanita Islam yang memakai tudang amat kecil. Ramai

juga yang diperlekehkan apabila bertudung. Tiada arahan daripada

kerjaan, JAKIM atau pejabat agama negeri mewajibkan wanita bertudung.

Tetapi kini lebih ramai wanita yang bertudung berbanding dengan yang

tidak bertudung. Perubahan ini dinamakan pergerakan undercurrent.

Kesedaran dan kehendak dari orangramai tanpa arahan kerajaan mampu

mengubah masa depan.

Untuk menjawab perkara kedua dan ketiga, mereka harus membaca pantun di bawah:

Berakit-rakit ke hulu,

Berenang-renang ke tepian,

Bersakit-sakit dahulu,

Bersenang-senang kemudian.

Jika

anda memahami pesanan orang-orang tua di dalam pantun di atas, anda

mesti faham kenapa gaji yang anda terima adalah rendah walaupun

mempunyai ijazah. Saya mempunyai kenalan hanya berkelulusan SPM tetapi

mempunyai gaji RM3,500 sebulan. Para pelajar saya pula rata-rata

menerima gaji lebih RM3,000 sebulan walaupun baru tamat pengajian

ijazah. Saya juga mempunyai kenalan yang berpendidikan setakat SRP tetapi mampu membina rumah besar, memiliki kereta Mercedes dan perniagaan yang bertambah maju. Jadi, anda harus berfikir, di manakah kesilapan anda. Memang mudah menyalahkan pihak lain daripada menyalahkan diri sendiri. Jalan utama ke arah pembaikan diri adalah dengan mengenal-pasti kelemahan diri dan diikuti dengan langkah-langkah untuk memperbaiki atau mengatasi kelemahan tersebut. Tanpa mengenal-pasti punca penyakit, seseorang doktor tidak akan dapat memberikan rawatan yang tepat.

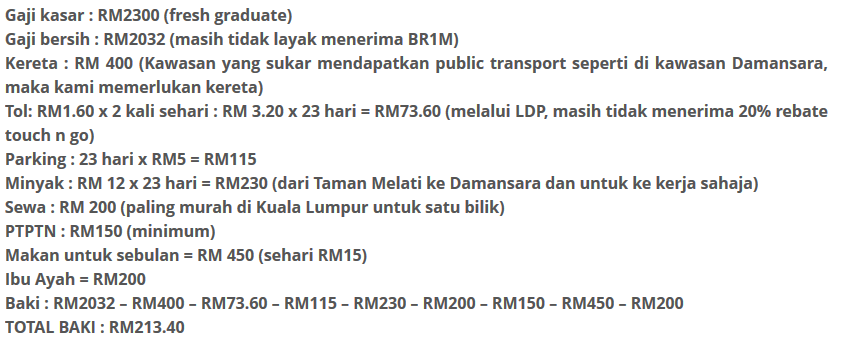

Pendapatan Siti Hajar Aladin adalah seperti berikut:

Saya harus memuji Siti Hajar Aladin kerana mempunyai kesedaran pembelian rumah

merupakan satu pelaburan masa hadapan. Saya juga memuji beliau kerana memperuntukkan sejumlah wang kepada ibubapanya setiap bulan (hampir 10% pendapatannya) samada mereka memerlukannya atau tidak. Ini merupakan salah satu langkah tepat di dalam pembinaan kekayaan. Mungkin ramai yang tertanya mengapa atau tidak bersetuju. Hanya mereka yang telah mengetahui rahsianya yang akan memahaminya.

Terdapat beberapa kelemahan di

dalam perancangan perbelanjaan Siti Hajar Aladin. Salah satu tips yang boleh saya

berikan adalah sebenarnya beliau berupaya membuat pinjaman di antara

RM160,000 hingga RM210,000 untuk bayaran bulanan sebanyak RM800 hingga

RM1026 sebulan. Dan pembayaran bulanan ini boleh dipertingkatkan

bergantung kepada kemampuan beliau merancang dan melaksanakannya. Di dalam perancangan tersebut, beliau juga terlupa untuk memasukkan peruntukkan derma dan pelaburan. Bagi orang lelaki, sudah menjadi kebiasaan bagi mereka untuk menderma pada setiap hari Jumaat selepas atau sebelum menunaikan sembahyang Jumaat. Tetapi bagi orang perempuan, dana derma juga perlu disediakan untuk pihak yang kurang bernasib baik. Pelaburan MESTI dilakukan setiap bulan samada kecil atau besar. Tetapi adalah lebih elok jika pelaburan tersebut di dalam satu jumlah yang tetap. Jika mampu, contohnya setiap kali mendapat bonus, pelaburan yang lebih besar boleh dilakukan.

Ramai akan mengatakan saya mengarut! Tetapi berikut adalah nasihat dan perancangan yang telah dilakukan oleh seseorang yang mendapat bimbingan saya. Pelbagai perancangan telah saya sediakan dan akhirnya dia melakukan

langkah paling berani dengan membeli hartanah pada keupayaan maksimum

memandangkan umurnya masih muda.

Gaji: RM2,200

Rumah dibeli: RM430,000

Jenis Rumah: Kluster 2 tingkat

Saiz rumah: 24' X 70', tanah 35' X 70'.

Bayaran Bank sebulan: RM1,800

Bimbingan saya ini berani melakukan pembelian ini setelah melakukan pelbagai analisa dan bukannya pakai tangkap muat atau bidan terjun. Dia amat mempercayai pantun di atas dan juga nasihat-nasihat berikut:

Adakah anda seseorang yang tergolong dikalangan mereka yang seperti Pak Kaduk,

Menang sorak,

Kampung tergadai

Atau:

Hendak, seribu daya,

Tak hendak, seribu dalih.

Akhir kata,

Tepuk dada,

Tanya mereka yang berjaya!

This is a volunteer publication work to promote self sufficiency, organic food, health, personal housing, property investment, life experiences and much more. If you feel my work merit for financial support, you can make the contribution using PayPal to zulfakar@gmail.com. If you want me to publish on a specific topic, you can also make a contribution as small as USD5 at zulfakar@gmail.com through PayPal. Then, I will do my best to provide the relevant information.

Wednesday, January 22, 2014

Sunday, January 5, 2014

Opportunity Cost in Property Investment

A Malay Pantun was written as:

Berakit-rakit ke hulu,

Berenang-renang ke tepian,

Bersakit-sakit dahulu,

Bersenang-senang kemudian.

How much are we willing to endure hardship so that we can have a bountiful life in the future? The Pantun teach us to work hard, have a frugal life as long as possible, always increase saving and investment in early life. If these are done properly and wisely, we can have a very comfortable life in the future.

In general, Property investment is a slow and steady game. Although some people who are impatient and desperate may employ a more aggressive strategy and tactics. Most of them can easily get caught in any economy turn down or any unexpected event. Some of them may have difficulty to expand their investment because their aggressive and risky style were checked by government restrictions.

Overall, property investment is a long term investment. You cannot expect immediate return within one or two months like supplying materials to customers. Although I have seen several cases where property investment can make quick gains, I do not advise the method to new comers unless you are very sure with your capabilities. But, it takes years of experience, network and learning to get once in a while quick and bountiful investment returns.

Thus, it is important to employ a conservative investment strategy. But at the same time we should also calculate the worst and best scenarios. The worst scenario is to ensure our investment is really protected if the situation is getting worst. The best scenario is to ensure we can get maximum return at the shortest time possible. These calculations are important to ensure we know how long should we hold our investment and how fast we should let go our investment. These calculation is also to ensure our sentiment does not affect our logical judgement.

At the micro level, opportunity cost always arise in our emotional calculation especially when there are too many good property investment opportunity! Which townships to choose, which hot area to choose: KL vs JB, which road to pick, which unit to select?!

This is when you need to become a Vulcan when making the consideration. A Vulcan is emotionless. Logic dictate all his decisions. Yet, we are human. It is normal to be overwhelmed with fantastic property we encountered with. However, not all property types, development and area are suitable for all property investors. We need to be alert with our own weaknesses to ensure not to pick a wrong investment.

A third party evaluator is essential if your feelings are mixed with your logical.thinking. It is the time to engage a mentor to assist your evaluation. The more I invest in property the.more I see various possibility of investment. But, I always make the decision based on the timing. Timing is everything!

Berakit-rakit ke hulu,

Berenang-renang ke tepian,

Bersakit-sakit dahulu,

Bersenang-senang kemudian.

How much are we willing to endure hardship so that we can have a bountiful life in the future? The Pantun teach us to work hard, have a frugal life as long as possible, always increase saving and investment in early life. If these are done properly and wisely, we can have a very comfortable life in the future.

In general, Property investment is a slow and steady game. Although some people who are impatient and desperate may employ a more aggressive strategy and tactics. Most of them can easily get caught in any economy turn down or any unexpected event. Some of them may have difficulty to expand their investment because their aggressive and risky style were checked by government restrictions.

Overall, property investment is a long term investment. You cannot expect immediate return within one or two months like supplying materials to customers. Although I have seen several cases where property investment can make quick gains, I do not advise the method to new comers unless you are very sure with your capabilities. But, it takes years of experience, network and learning to get once in a while quick and bountiful investment returns.

Thus, it is important to employ a conservative investment strategy. But at the same time we should also calculate the worst and best scenarios. The worst scenario is to ensure our investment is really protected if the situation is getting worst. The best scenario is to ensure we can get maximum return at the shortest time possible. These calculations are important to ensure we know how long should we hold our investment and how fast we should let go our investment. These calculation is also to ensure our sentiment does not affect our logical judgement.

At the micro level, opportunity cost always arise in our emotional calculation especially when there are too many good property investment opportunity! Which townships to choose, which hot area to choose: KL vs JB, which road to pick, which unit to select?!

This is when you need to become a Vulcan when making the consideration. A Vulcan is emotionless. Logic dictate all his decisions. Yet, we are human. It is normal to be overwhelmed with fantastic property we encountered with. However, not all property types, development and area are suitable for all property investors. We need to be alert with our own weaknesses to ensure not to pick a wrong investment.

A third party evaluator is essential if your feelings are mixed with your logical.thinking. It is the time to engage a mentor to assist your evaluation. The more I invest in property the.more I see various possibility of investment. But, I always make the decision based on the timing. Timing is everything!

Wednesday, January 1, 2014

Wise Atmel AVR SDK

I developed this product for a local company. The product is ready for mass production and sell after two years being tested in my faculty. More than 30 design ideas have been successfully implemented including commercial projects. Anybody interested can order from me or the company.

The deliverable is between 2-3 weeks.

We also offer services such as:

1. Training for end users and for trainers

2. Training modules or ideas such as

a) Room Temperature control

b) Smart Locker

c) ATM machine

and many more

3. Design services based on Atmel AVR, Microchip PIC, ARM, and Altera FPGA.

The selling price is RM450.00. The minimum order quantity is 5 units. The SDK includes

a) the Atmel AVR main SDK board

b) Atmel AVR programmer

To order, you can contact:

sales.wisepath@gmail.com

The deliverable is between 2-3 weeks.

We also offer services such as:

1. Training for end users and for trainers

2. Training modules or ideas such as

a) Room Temperature control

b) Smart Locker

c) ATM machine

and many more

3. Design services based on Atmel AVR, Microchip PIC, ARM, and Altera FPGA.

The selling price is RM450.00. The minimum order quantity is 5 units. The SDK includes

a) the Atmel AVR main SDK board

b) Atmel AVR programmer

To order, you can contact:

sales.wisepath@gmail.com

Subscribe to:

Comments (Atom)